Retail media has grown up fast. What started as a straightforward way to capture search dollars at the point of purchase is now one of the most scrutinized and strategic channels in the industry. Retail media is no longer just about conversion rates and ROAS—it’s about proving that it can deliver brand-building reach, performance-driven accountability, and shopper marketing outcomes all at once.

The power of RMNs is that they can act as the connective tissue — giving shopper, brand, and performance teams the tools to pursue their own goals while still contributing to a bigger, unified strategy. The challenge, however, is that most are not set up this way yet. In fact, according to our latest retail media research report, cross-functional misalignment is one of the top barriers to retail media investment. The problem isn’t just teams fighting over the same dollars—it’s that most RMNs only serve one set of success criteria well, leaving budgets stuck in silos instead of working together.

Off-Site Media: Small Slice, Outsized Potential

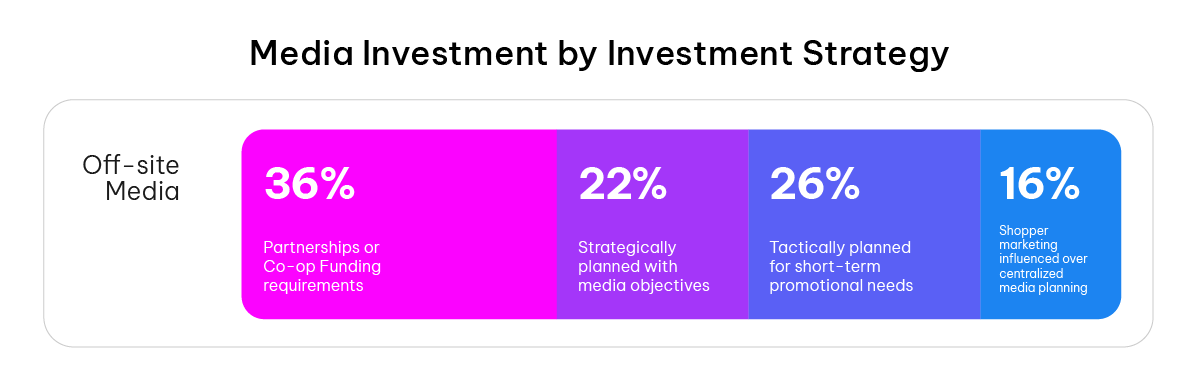

According to our study, off-site media accounts for just 16% of RMN budgets among agency buyers. But among those reallocating budgets strategically, off-site display and video are at the top of their priority list, right behind CTV and ahead of social. What’s more interesting is that co-op funding, traditionally reserved for in-store or owned digital placements, makes up 36% of off-site spending, reinforcing the growing value of extending first-party data beyond a retailer’s walls. Why? Because off-site solves a problem on-site can’t: reaching customers across their entire journey, not just at the point of sale.

Consider shoppable formats, which currently represent just 5% of RMN investment but are projected to grow 18% by 2026. As display, video, and CTV formats become shoppable by design, the path from inspiration to purchase becomes seamless within the ad experience itself. This evolution transforms shoppability from a standalone format into a feature that unlocks new value across the entire funnel.

Yet execution remains challenging. Most retail media platforms weren’t designed for cross-channel strategies; they were built to optimize product placement, manage sponsored listings, and deliver on-site display. Expanding outside the walls into display, CTV, and DOOH requires entirely new capabilities. That’s why enabling off-site programmatically is so critical, as it allows advertisers to buy seamlessly across channels while still leveraging retailers’ first-party data, helping fill demand more efficiently and positioning RMNs as true full-funnel partners.

CTV and DOOH: Turning Awareness Channels Into Performance Engines

If off-site is the growth vector, CTV is the format rewriting expectations. Based on our findings, it already represents 23% of RMN spend in 2025, with investment projected to rise further. The challenge is that many are still treating CTV like a traditional awareness channel while buyers expect performance-driven sophistication. The gap between expectation and execution is where opportunities are won or lost.

“CTV is the format that could redefine RMNs if we prove it works beyond awareness.” – Agency Exec

That same principle extends beyond the living room. Digital out-of-home (DOOH) is beginning to play a similar role in bridging brand and demand for retail media. By layering retailer first-party data onto DOOH inventory—whether it’s billboards near a competitor’s store or digital screens in high-traffic urban areas—retailers can transform a traditionally broad-reach channel into one that’s measurable, targeted, and programmatically activated. When connected to mobile retargeting or in-store promotions, DOOH stops being an isolated awareness tactic and becomes part of a more closed-loop system.

What This Means For Retailers

The land grab for search budgets and sponsored listings isn’t over, but the real growth lies in off-site and advanced formats. Our research shows that brand and performance budgets are now the leading sources of reallocated retail media investment, with advertisers expecting both brand-building and conversion-driven outcomes from the same platforms. The RMNs that scale most effectively will be those that enable full-funnel execution programmatically, connecting on-site and off-site into a unified ecosystem.

Delivering on that expectation requires more than incremental fixes. It calls for composable infrastructure, seamless API integrations, and partnerships with technology providers that can bring programmatic sophistication to life.

Retailers who solve for brand and performance together won’t just protect existing spend—they’ll unlock entirely new demand.

This analysis is based on our comprehensive 2025 Retail Media Research Report, surveying agency professionals responsible for retail media buying decisions. You can download the full report here.