Every week seems to bring a new retail media launch or partnership announcement. Investment is rising, innovation is happening, and retailers across verticals are racing to build and/or improve their media networks.

But when we surveyed agency leaders for our latest research, a more nuanced picture emerged.

Our latest research pulls back the curtain on how agencies are actually planning, buying, and thinking about retail media today. Based on in-depth findings from media buyers at leading agencies, the report captures a prominent media channel in motion: growing fast, full of potential, but still navigating critical growing pains.

To put it in perspective: Retailers are transforming from transactional businesses into media companies, leveraging first-party data and purchase signals. This shift blurs the traditional lines between publisher and advertiser. Now, retailers are the media owner, the data provider, and the seller, all at once.

While RMNs aren’t exactly new (Amazon launched theirs in 2012), many retailers are still playing catch-up, with core competencies in merchandising and store operations, not media technology or ad platforms. That’s not inherently a problem. But the research is clear: retail media isn’t stalling, it’s hitting friction.

And that’s not just because these media networks have an experience gap. It’s the byproduct of rapid change in the way media is being bought and who owns retail media decision-making across brand and agency teams.

Strategic Intent, Tactical Reality

91% of agency buyers say RMNs are part of a strategic media plan — yet nearly 80% admit they’re still planned tactically, through short bursts, seasonal pushes, and vendor funds.

It’s not a lack of belief in retail media. Belief is not the issue. Execution is. Not in theory, but in the day-to-day grind of trying to run media campaigns on infrastructure that wasn’t always built for the complexity retail media now demands.

Our research found that:

- Teams struggle with alignment: Agencies say retail media touches nearly every team – brand, performance, shopper, programmatic, commerce – but without clear ownership, execution, and measurement becomes fragmented.

- Tactical budgets dominate: RMNs are still largely funded by shopper and trade budgets, even when there’s a desire to use brand-building tactics like CTV or upper-funnel video, often owned by other buying teams with more strategic implications.

- The process is murky: 85% of agencies say there’s no standard approach to buying retail media. Every RMN works differently, which adds friction to the buying process.

“The appetite is there,” one buyer told us. “But we’ve outgrown the way retail media is currently being executed.”

Everyone’s Involved, But No One Owns It

Our research shows that fragmented budget ownership is one of the biggest roadblocks to deeper investment in RMNs. When dollars are split across teams with competing KPIs – brand, performance, shopper, commerce – it slows decisions and prevents retail media from being integrated into the broader media strategy.

This complexity is amplified by the fact that RMN ad formats, such as sponsored listings, off-site video and display, and CTV, don’t fit neatly into one category anymore. They can serve both brand and performance objectives, making it unclear who should own the buy or define success.

A truly unified retail media strategy requires multiple stakeholders and teams to come together to ensure consistent brand messaging across various channels and consumer touchpoints. Teams that take an integrated approach can more effectively allocate resources, eliminate redundancies, and streamline efforts to maximize impact.

A Fuller Picture with Full-Funnel

RMNs are quickly evolving from lower-funnel conversion tools into full-funnel advertising platforms that can drive awareness, consideration, and sales. While only 7% of agency buyers currently see RMNs as an upper-funnel medium–the lowest among all media types–momentum is shifting. Today, 40% of buyers expect RMNs to perform across the entire funnel, a figure second only to social media (52%). This shift reflects advertisers’ growing recognition that RMNs, with their unique combination of first-party purchase data and direct shopper access, can support brand-building goals in addition to performance goals.

Infillion’s omnichannel DSP–MediaMath–is primed to help RMNs take advantage of this full-funnel potential. Its programmatic platform integrates retailers’ first-party data and owned inventory with other digital channels, enabling brands to unify awareness-driving buys with conversion-oriented activations. Its measurement and attribution tools—built to quantify incremental lift and multi-touch impact—address the growing demand to prove RMN effectiveness beyond last-click metrics. With established partnerships across leading data, tech, and supply partners, in addition to proprietary tools, MediaMath offers the infrastructure to deliver on rising expectations for retail media as a holistic, brand-and-performance channel.

CTV and Off-Site Are High Interest, Low Maturity

Retailers continue to put an emphasis on evolving their media networks, from adding off-site capabilities such as CTV, display, video, and DOOH to AI-driven targeting and beyond, but very few are actually set up successfully to deliver these capabilities.

Buyers want to take retail media beyond the retailer’s walls. Off-site media – particularly CTV – is emerging as a powerful channel for driving upper- and mid-funnel engagement while staying connected to commerce outcomes.

76% of respondents expect their CTV investment through RMNs to increase this year. That aligns with broader demand for audience-first, omnichannel planning. What’s more, CTV is expanding into more shoppable video experiences, giving viewers the ability to engage and purchase without leaving the big screen.

Meanwhile, off-site media accounts for just 16% of budgets today. But among buyers reallocating budget from other channels, off-site display and video is one of the top picks, second only to CTV.

With the right infrastructure, buyers can:

- Use retailer’s data to inform personalized creative across off-site channels, including CTV and display

- Retarget based on real purchase intent across multiple channels

- Drive continuity between a sponsored product and a storytelling moment

To fully realize this opportunity, RMNs need better measurement, creative tools, and technical integration. Buyers are no longer thinking in silos, and RMNs must evolve to support a more connected approach.

What Buyers Want From Retail Media Networks

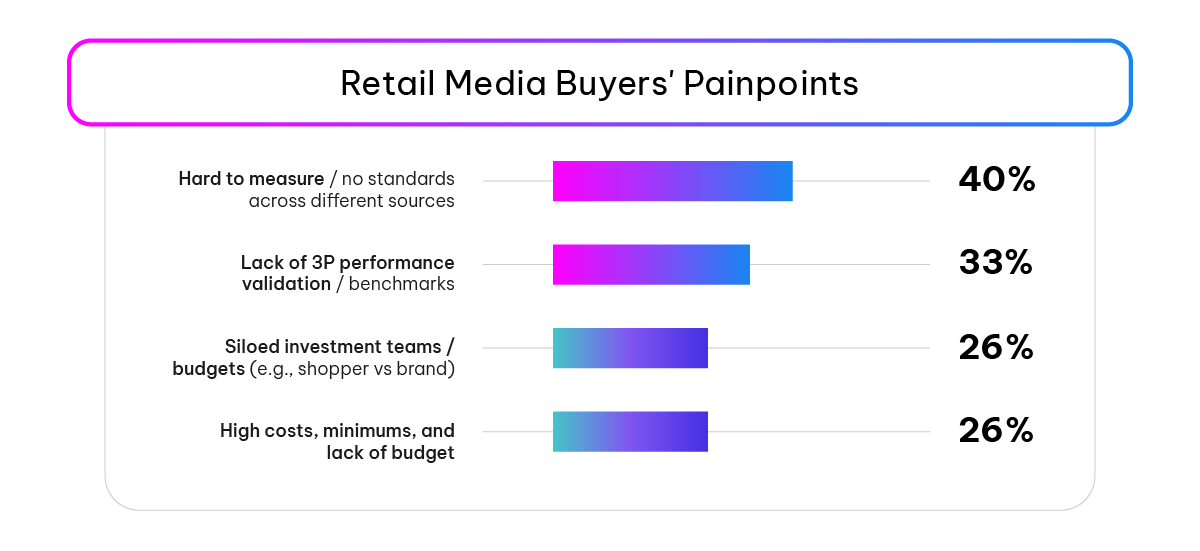

Top concerns reflect a demand for more consistency, transparency, and strategic alignment. According to our research, 40% of buyers say it’s still too hard to measure retail media performance due to inconsistent standards across platforms. Another 33% are frustrated by the lack of third-party validation or benchmarks, which makes it difficult to assess effectiveness or optimize spend.

As mentioned earlier, this isn’t just about performance metrics, it’s about integration. One in four buyers (26%) say their teams are siloed, with separate budgets and goals for shopper vs. brand investment. And another 26% point to high costs and inflexible minimums as barriers to scale.

The most valuable RMNs going forward will be the ones that act more like media partners and less like walled gardens. The biggest opportunity isn’t just to sell more inventory, it’s to become easier to plan with, buy from, and trust. That means:

- Clarifying how your network fits into the full media plan, not just shopper strategy

- Making off-site inventory easier to buy and measure

- Standardizing how agencies access and activate your offerings by integrating the right tech stack to scale

In a growing space, the RMNs that win will be the ones that reduce complexity, not add to it. It’s not their job to fix buying models and team structures, but to support them with the components and tools to plan and activate against tactical and strategic KPIs.

What You Can Do Now

For retailers, this moment is a turning point, not a setback. Here’s where to focus:

- Audit your infrastructure: Are your RMN platform capabilities and tech stack set up for the needs of your advertisers? Make sure your systems work together seamlessly and can offer programmatic access to both on-site and off-site placements.

- Plan for flexibility: Start setting up internal processes and flexible frameworks that enable buyers to execute full-funnel strategies without juggling multiple platforms.

- Pressure-test measurement: Are your current tools limited to your own walled-garden measurement capabilities? Integrate with third-party measurement partners to validate performance.

- Lean on partners: Work with tech partners that focus on growing with you. MediaMath’s API-first, enterprise-grade architecture integrates seamlessly into existing workflows, identity solutions, and retail tech stacks, offering agencies and brands a single DSP environment that supports flexibility, control, and omnichannel execution.

Our full research report, Getting Real About Retail Media, goes deeper into these dynamics – exploring team structures, investment trends, measurement gaps, and what buyers truly need from RMNs as they evolve.