Retail media has become a core growth channel for retailers and brands alike. Networks have expanded beyond onsite placements, built sophisticated audience strategies, and increasingly positioned retail media as a performance engine.

As that growth continues, one issue keeps surfacing in conversations with advertisers: performance measurement still leans heavily on ecommerce outcomes, even though a large share of retail sales happen in physical stores.

For many retail media networks, this creates a growing disconnect. Campaigns influence demand across channels, but success is often evaluated through an online-only lens. As brands push for clearer proof of total business impact, the pressure to connect digital exposure to in-store outcomes has become one of the most persistent challenges in retail media today.

The industry is openly calling out attribution as a core retail media challenge

Measurement has become one of the most discussed friction points in retail media’s evolution.

eMarketer has consistently identified attribution and performance measurement as major challenges for commerce and retail media networks, particularly when it comes to connecting digital ad exposure with both online and in-store purchases. In its analysis of retail media scaling challenges, eMarketer highlights the difficulty of attributing outcomes across channels as a central barrier to growth.

The same theme appears across broader retail media coverage. While closed-loop attribution is often positioned as a core advantage of retail media, the reality is more nuanced. Nielsen has noted that many advertisers assume retail media naturally solves attribution because of its proximity to transaction data, even though connecting exposure to outcomes across environments remains complex in practice.

As retail media expands beyond onsite placements and into offsite channels like programmatic display, video, and CTV, those attribution challenges only become more pronounced. eMarketer has pointed out that integrating off-site media into retail media strategies introduces additional complexity in tying ad exposure back to purchase behavior.

Together, these perspectives reinforce a common industry reality: the closer retail media gets to omnichannel scale, the more difficult it becomes to rely on ecommerce-only performance reporting.

Why ecommerce-only measurement increasingly falls short

E-commerce attribution offers clarity and speed, which is why it became the default reporting framework for many retail media programs. But as retail media matures, its limitations are becoming more visible.

In physical store-led markets and categories, a large portion of campaign-driven demand converts offline. When those purchases aren’t consistently connected to digital exposure, performance appears smaller than it actually is. Over time, that shapes how budgets are allocated, how success is defined, and how RMNs position the value of their media.

This also impacts off-site growth. Offsite media is one of the biggest expansion opportunities for retail media networks, but it places even more emphasis on outcome connectivity. When impressions happen outside the retailer’s owned properties, brands want clearer proof that those exposures drive real sales – particularly in-store.

Without a way to consistently connect digital engagement to offline outcomes, RMNs are left defending performance through partial signals rather than full-funnel truth.

The push for standardized omnichannel measurement reflects the same gap

The industry’s effort to formalize retail media measurement standards is another indicator of how much work remains.

In 2024, the IAB and Media Rating Council released the Retail Media Measurement Guidelines, calling for clearer inclusion of both online and offline ad activity and outcomes within retail media reporting frameworks. The guidelines emphasize the need to distinguish between digital and in-store results so performance can be evaluated more consistently across networks.

Rather than introducing new metrics for the sake of complexity, the guidelines reflect what buyers have been asking for: visibility into outcomes that align with how consumers actually shop.

The fact that these standards are still being established underscores a broader truth — omnichannel measurement in retail media is still evolving, and many existing reporting models haven’t fully caught up to real-world purchase behavior.

How Walmart approached omnichannel performance differently

This measurement gap is what Walmart Connect Mexico and Infillion set out to address.

Operating in a market where digital and physical shopping journeys are tightly linked, Walmart Connect Mexico faced a familiar retail media challenge. According to AMVO Estudios, in Mexico, 82% of shoppers combine digital and physical channels when making purchases, making ecommerce-only measurement an incomplete view of performance.

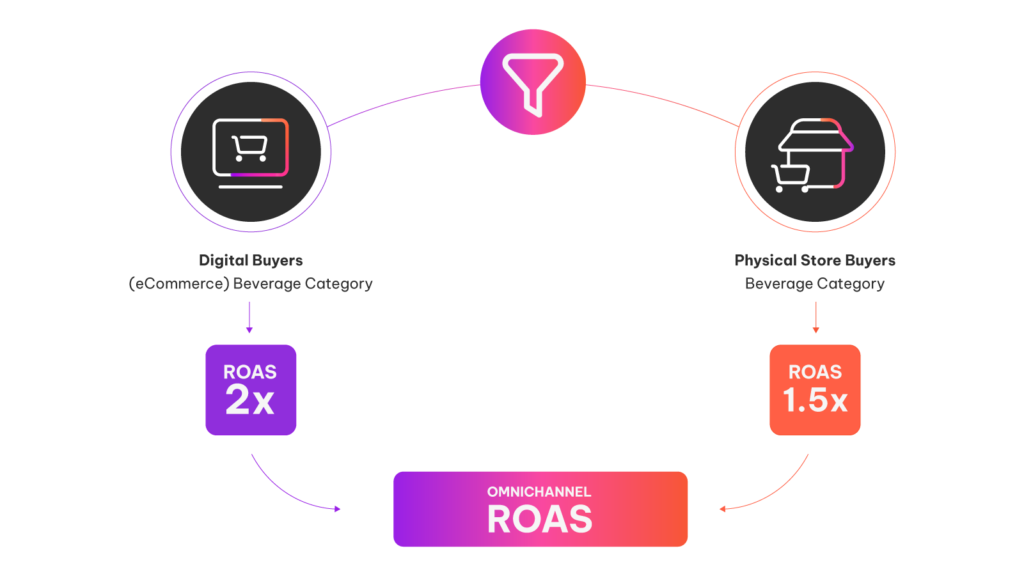

Walmart Connect Mexico, powered by Infillion’s white-labeled MediaMath technology, introduced enhanced omnichannel audience activation and measurement – extending advertiser visibility beyond e-commerce to include in-store (POS) sales. Built on Infillion’s composable architecture, these capabilities unify first-party audience activation with closed-loop attribution, enabling brands to measure how digital media influences the full shopper journey.

Advertisers using omnichannel audiences and attribution on Walmart DSP are seeing meaningful ROI uplift across key categories, including more than 50% in groceries, 60% in beauty and hygiene, and 45% in alcoholic beverages.

One example is NIVEA. By activating both in-store and online audiences and measuring performance across channels, the brand drove an 80% increase in ROAS – demonstrating the incremental value of omnichannel measurement in action.

For retail media networks under growing advertiser pressure, measurement has to evolve to match how consumers actually shop across channels.

Why this matters for the next phase of retail media growth

Retail media’s early growth was fueled by access to first-party data and proximity to purchase. The next phase will be shaped by accountability.

As budgets increase and programs mature, brands are placing greater emphasis on outcome transparency. They want to understand not only what drove online conversions, but how media influenced total sales, especially in physical stores where much of retail revenue still lives.

Industry analysts continue to point to attribution as one of the most important challenges retail media must solve to sustain long-term growth. eMarketer’s ongoing coverage of commerce media consistently frames performance measurement across channels as a critical pressure point for networks looking to scale.

Consumers already move fluidly between digital and physical shopping environments. Retail media measurement is now under pressure to do the same. The RMNs that lead the next stage of retail media growth will be the ones that can consistently connect digital engagement with in-store outcomes – turning omnichannel behavior into true performance.

Download the case study to see how connecting in-store audiences and purchases with digital engagement creates a clearer, more complete view of retail media success.